With the new federal reporting requirements under the Corporate Transparency Act (CTA) set to take effect on January 1, 2024, it’s critical to understand if your business is a Reporting Company, since this will determine whether or not a Beneficial Ownership Information (BOI) filing is required.

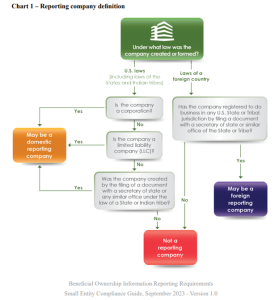

The flow-chart included below is FinCEN’s definition of what constitutes a Reporting Company. The chart highlights that any company that is a Corporation, LLC, or was otherwise formed by filing a document with a Secretary of State for any State or Indian Tribe, could potentially be a Reporting Company. The chart also explains that a company formed under a foreign government’s laws but has filed with a Secretary of State for any State or Indian Tribe in order to do business in the United States, may also be required to submit a BOI report.

The reason this definition only determines if a company may be a Reporting Company is because there are 23 possible exemptions. Below is FinCEN’s list of exempt companies:

| Exemption No. | Exemption Short Title |

| 1 | Securities Reporting Issuer |

| 2 | Governmental Authority |

| 3 | Bank |

| 4 | Credit Union |

| 5 | Depository Institution Holding Company |

| 6 | Money Services Business |

| 7 | Broker or Dealer in Securities |

| 8 | Securities Exchange or Clearing Agency |

| 9 | Other Exchange Act Registered Entity |

| 10 | Investment Company or Investment Adviser |

| 11 | Venture Capital Fund Adviser |

| 12 | Insurance Company |

| 13 | State-licensed insurance producer |

| 14 | Commodity Exchange Act registered entity |

| 15 | Accounting Firm |

| 16 | Public Utility |

| 17 | Financial Market Utility |

| 18 | Pooled Investment Vehicle |

| 19 | Tax-Exempt Entity |

| 20 | Entity Assisting a Tax-Exempt Entity |

| 21 | Large Operating Company |

| 22 | Subsidiary of Certain Exempt Entities |

| 23 | Inactive Entity |

FinCEN has published a Small Business Compliance Guide that includes a more detailed definition of each exemption. If you think one of the exemptions might apply to your company, it's a good idea to refer to the Compliance Guide here and seek guidance from your legal counsel.

A quick note regarding change in exemption status: If your company is required to submit a BOI report upon formation, then later qualifies for an exemption status, there is no further reporting to FinCEN that is required. If, on the other hand, your company was classified as exempt at the time of formation, but later becomes non-exempt, you must submit a BOI report to FinCEN 30 days.

All information provided by FinCEN is subject to change. CLAS Information Services will continue to provide you with updates as new information becomes available.

Be sure to visit the CLAS CTA Reference Center for practical information about the CTA, FAQs, educational videos, guest blogs from corporate attorneys, and much more!

>> Take me to the CLAS CTA Reference Center!

Disclaimer: CLAS Information Services does not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied upon for, tax, legal, or accounting advice. We recommend that you consult the appropriate advisor before engaging in any future transactions.